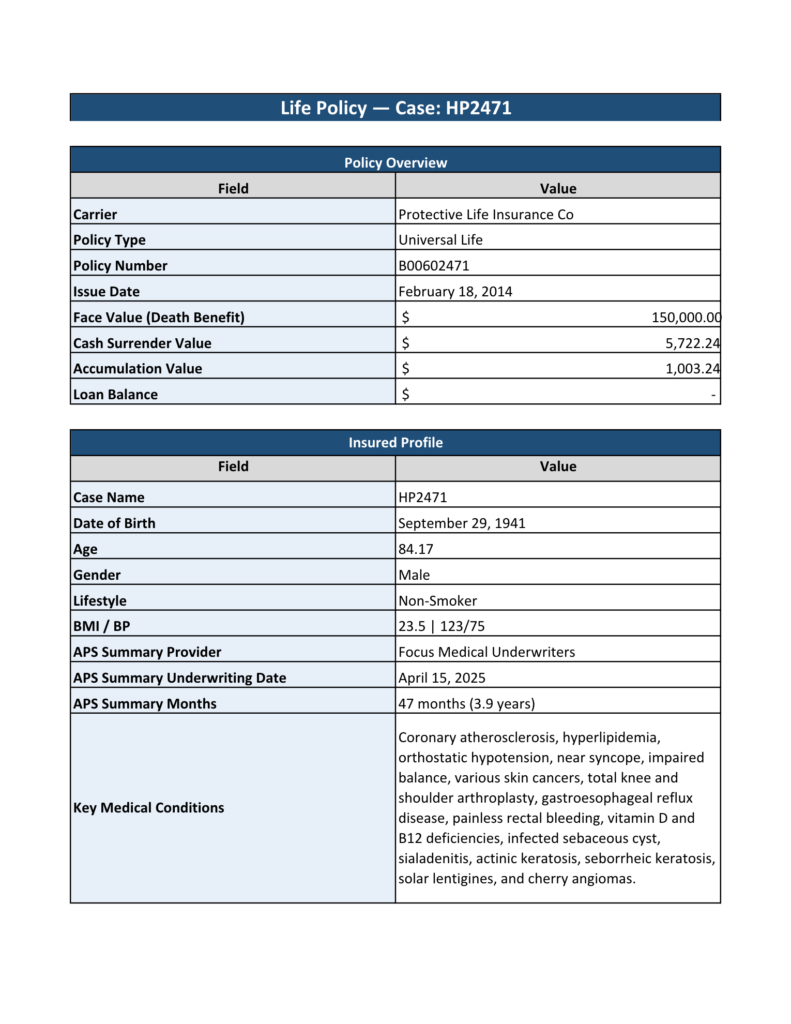

Case HP2471 offers investors a compelling opportunity to access a high-quality, non-correlated life settlement backed by a fully collateralized U.S. life insurance policy issued by an A+ rated carrier. The policy features a projected death benefit of $150,000 with a total base-case investment of $79,054 over a 3.9-year actuarial life expectancy.

The investment delivers a 22.8% annualized ROI at base case, representing a 1.9x equity multiple, with upside potential in shorter maturity scenarios. The insured profile reflects advanced age and multiple documented medical conditions, supporting actuarial assumptions. Investors hold direct title and ownership of the policy, ensuring transparency and control. Designed for capital preservation and stable returns, HP2471 provides disciplined exposure to a proven, non-market correlated asset class.

Policy Overview

Reserve Policy & View Data Room

Highlights

Strong Base-Case Return: 22.8% Annual ROI at 3.9-year LE, 1.9× equity multiple.

Collateralized by U.S. life insurance policy issued by A+ rated carrier.

Investor holds direct title and ownership of the policy.

Non-correlated asset class.

Risks & Considerations

Longevity Risk: Returns decline if insured lives beyond APS.

Premium Continuity: Required to maintain policy in force.

Illiquidity: Investment is illiquid until maturity or resale.

Servicing Fees: Ongoing costs for policy servicing after year 3.

- Preparing For Your Future

Achieving Your Vision

Building a strong investment strategy is essential to long-term capital growth and protection. At High Yield Vault, we work closely with investors to identify their objectives and construct tailored life settlement investment strategies designed to deliver stable, non-correlated returns. Through disciplined due diligence, transparent structures, and institutional-grade execution, we help investors deploy capital with confidence while reducing exposure to traditional market volatility.

- WHY US ?