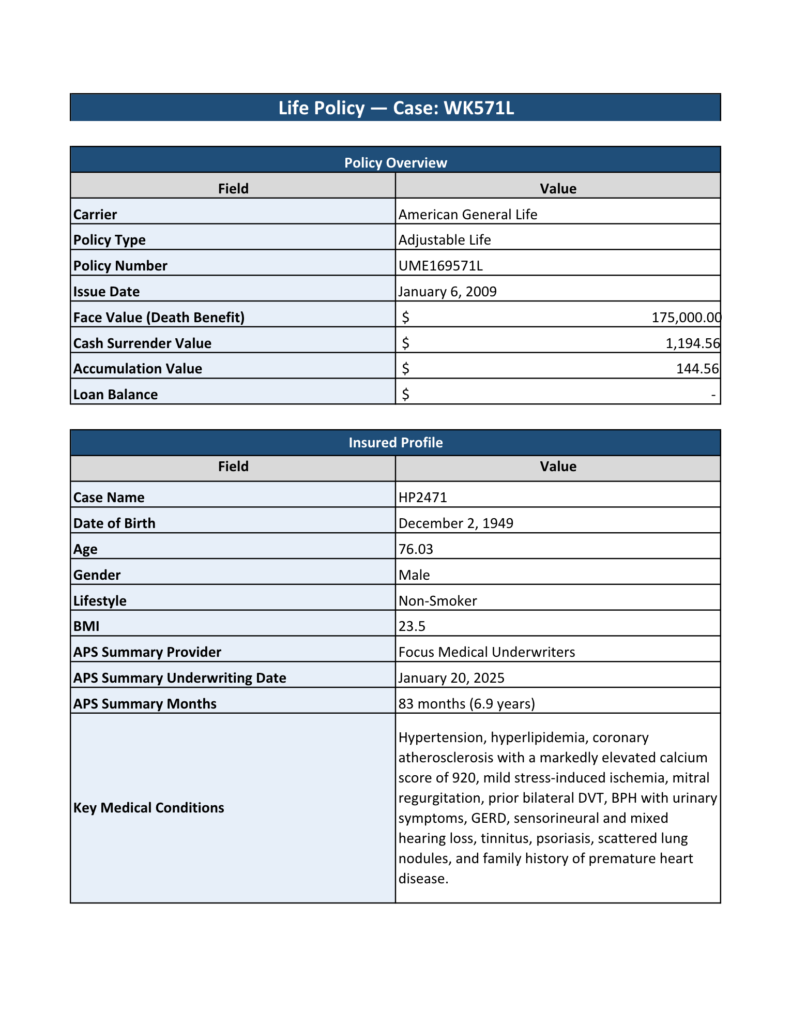

Unlock a rare opportunity to access a high-yield, non-correlated life settlement backed by a fully collateralized U.S. life insurance policy issued by an A+ rated carrier. Life Policy WK571L features a projected death benefit of $175,000 with a total investment of $76,512 over an 83-month (6.9-year) actuarial life expectancy, delivering 23.2% annualized ROI and a 2.69× equity multiple.

This is direct ownership—you hold the title, control the asset, and gain access to a proven alternative investment class designed for portfolio diversification and long-term stability. Past returns highlight consistent performance, from 84.6% in 2 years to 10.3% in 9 years, offering a clear, data-driven path to wealth growth.

The insured, a male non-smoker born in 1949, presents multiple documented medical conditions, supporting actuarial assumptions and enhancing base-case returns. This unique profile creates a secure foundation for high-growth potential.

Why choose WK571L?

- Non-correlated asset class, ideal for portfolio diversification

- Strong projected returns with upside potential for early maturity

- Full transparency and direct ownership

- Backed by an A+ rated U.S. insurer

While liquidity is limited until maturity or resale, and ongoing premiums and servicing fees apply, High Yield Vault WK571L is tailored for discerning investors seeking exclusive, high-return opportunities outside traditional markets.

Take advantage of a secure, high-performing, and truly differentiated investment—experience the power of High Yield Vault today.

Policy Overview

Reserve Policy & View Data Room

Highlights

Strong Base-Case Return: 23.2% Annual ROI at 6.9-year LE, 2.69× equity multiple.

Collateralized by U.S. life insurance policy issued by A+ rated carrier.

Investor holds direct title and ownership of the policy.

Non-correlated asset class.

Risks & Considerations

Longevity Risk: Returns decline if insured lives beyond APS.

Premium Continuity: Required to maintain policy in force.

Illiquidity: Investment is illiquid until maturity or resale.

Servicing Fees: Ongoing costs for policy servicing after year 3.

- Preparing For Your Future

Achieving Your Vision

Building a strong investment strategy is essential to long-term capital growth and protection. At High Yield Vault, we work closely with investors to identify their objectives and construct tailored life settlement investment strategies designed to deliver stable, non-correlated returns. Through disciplined due diligence, transparent structures, and institutional-grade execution, we help investors deploy capital with confidence while reducing exposure to traditional market volatility.

- WHY US ?